Turns out that for the right person, renting in the last 20 years was not a financial mistake

A disciplined renter has at least an equal opportunity to accumulate wealth if they are saving diligently and investing in a low-cost portfolio of stocks, a new analysis finds.Christinne Muschi/The Canadian Press

There’s a common belief that for the last 20 years renting a home in Canada has been a financial mistake. That belief is wrong – or at least requires a more nuanced interpretation.

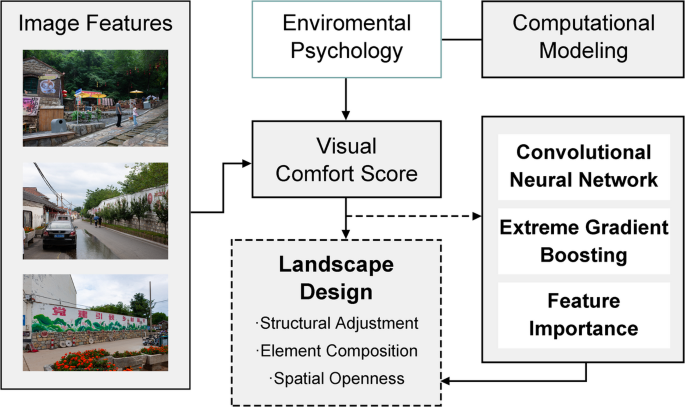

To prove this, we looked at long-term financial outcomes for renters and owners based on apartments in twelve Canadian cities in the two decades ending December 2024. Our results challenge the view that renting has hurt Canadians’ finances.

It’s well known that the wealth of renters trails owners’ wealth by a wide margin. The problem with renter versus owner net worth data is that renter households tend to be younger and lower income. The fact that they are renters does not fully explain why their wealth is lower. Owning a home would not increase their age or income.

To sidestep these confounding factors, our analysis holds income constant and compares the hypothetical wealth outcomes of a renter and owner who made the decision to rent or buy in January, 2005. From there, using real Canadian data for home prices, rents, property taxes and inflation, we calculated the net worth of the renter and owner in December, 2024.

Youngest group of first-time buyers make up large share of Ontario home purchases, data show

In our model, a hypothetical renter has saved up enough for a down payment and closing costs to buy an apartment. If they keep renting, they will invest their savings in a diversified portfolio of stocks. If they buy a home, they will finance their purchase with a 20 per cent down payment on a five-year fixed mortgage with a 25-year amortization.

The model holds available cash flow constant at the owner’s cash flow needs including property taxes, maintenance costs, insurance and their mortgage payment.

The renter has the same available cash flow as the owner but doesn’t necessarily spend it all on rent. Any monthly difference between the owner’s and renter’s cash flow needs is added to the renter’s diversified stock portfolio if it’s positive and withdrawn if it’s negative.

This assumption is critically important.

If you’re going to rent and spend instead of rent and save, you’re likely better off owning a home. But as the results of this analysis demonstrate, a disciplined renter has at least an equal opportunity to accumulate wealth if they are saving diligently and investing in a low-cost portfolio of stocks.

After running the model through the full 20 years of historical data, we find that in seven of the twelve cities – including Toronto – renters accumulated more wealth than owners.

The reason is simple: Canadian real estate returns were mixed across cities, while diversified stock market investments – an alternative for building wealth – increased in value for renters regardless of the city they lived in.

To put some numbers to it, the average 20-year annualized price return for owners for the twelve cities in our sample was 5.11 per cent. Kitchener-Waterloo had the highest return with an annualized price return of 6.99 per cent while Edmonton was the lowest at 3.08 per cent. To contrast, the renter’s stock market portfolio in the model returned an annualized 8.35 per cent, net of estimated fees.

These returns are not a great comparison because renters do also need to pay rent. Rent in the model increases each year based on the historical rent increases in each city. On average, the annual rent increases over this period were 6.24 per cent per year.

These unexpected costs could derail your plan to buy a home

We find that owning tends to look better in cities with the highest rate of rent increases. This speaks to the hedging benefit of owning – it can protect you from getting priced out of a specific home.

We measure the final 20-year outcome as the ratio of renter to owner wealth. A ratio above one indicates that renters came out ahead while below one indicates that owners came out ahead. Taking an average of the results across all twelve cities, renters and owners are roughly even with a very slight advantage for owners.

While these baseline results are encouraging for renters, changing the assumptions can make a big difference.

The renter’s portfolio in the model consists of 30 per cent Canadian equity and 70 per cent global equity index funds with an annual fee of 0.25 per cent, similar to VEQT. A more conservative portfolio would make renting look worse.

The portfolio is not taxed, since the renter is using FHSA, RRSP and TFSA accounts (as they became available throughout the sample period). Using taxable investments would make owning increasingly attractive at increasing personal income tax rates.

Higher investment fees and a failure to save the cash flow cost difference between renting and owning would similarly reduce the renter’s wealth accumulation, putting them at a financial disadvantage to owners.

The sensitivity of the results to those assumptions, and the fact that many Canadians have low financial literacy and invest in high-fee actively managed funds, suggests home ownership may make sense for a lot of people.

However, as this analysis demonstrates, a disciplined renter could have matched the wealth of a homeowner in many cities across Canada for the period 2005-2024. For the right person, renting has not been a mistake.

A more detailed description of the model, data sources and results is available in our new paper.

Benjamin Felix is the chief investment officer and a portfolio manager at PWL Capital.

link