Current Mortgage Rates: Week of May 13 to May 17, 2024

Money’s main takeaways:

- Today’s average rate on a 30-year fixed-rate mortgage is 7.504%, a decrease of 0.047 percentage points, according to Money’s daily rate survey.

- Today’s average rate on a 30-year fixed-rate refinance loan is 8.156%, moving down by 0.033 percentage points, according to Money’s daily rate survey.

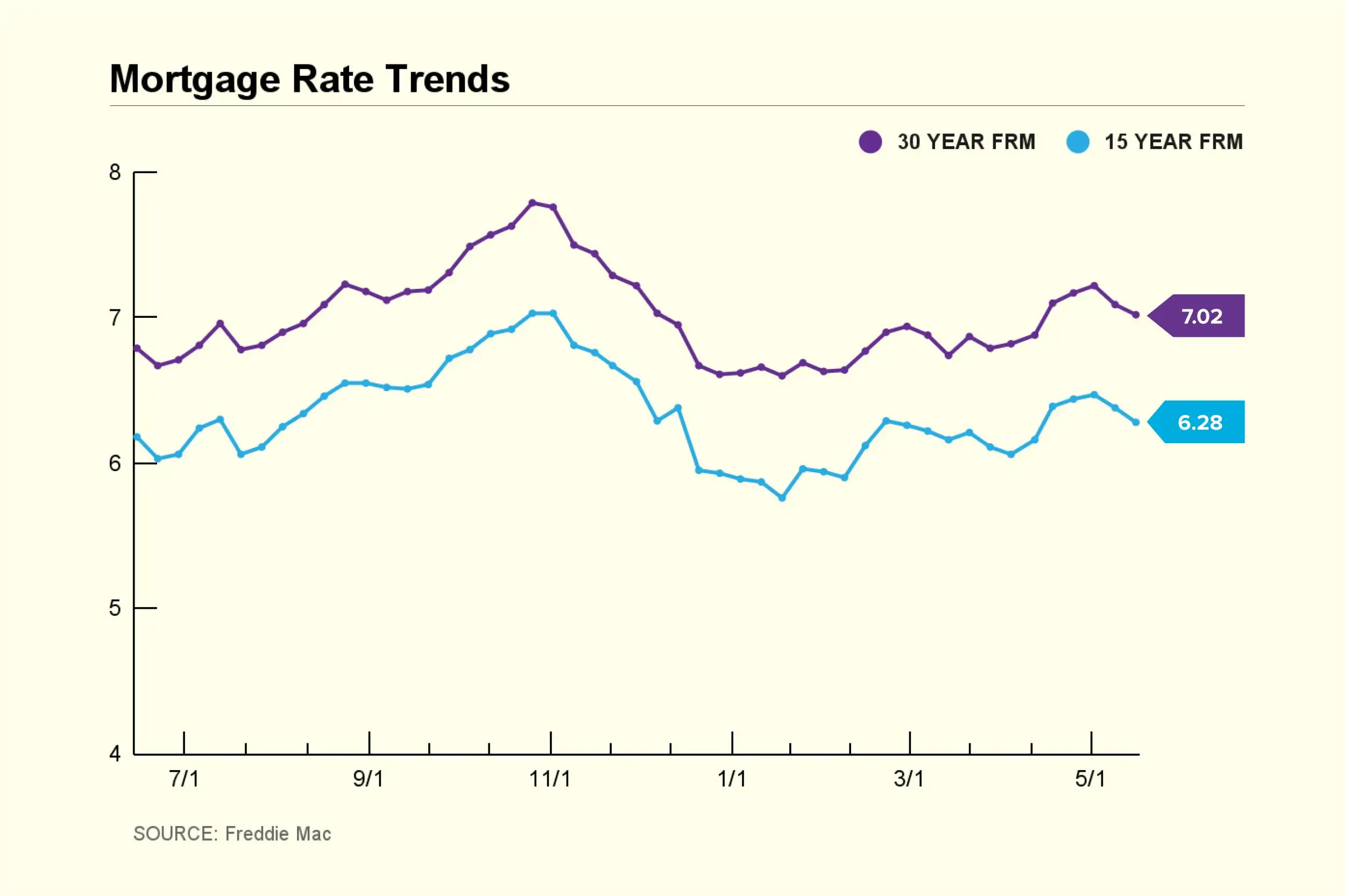

- Freddie Mac’s current rate for a 30-year fixed-rate mortgage is 7.02%, a decrease of 0.07 percentage points. A year ago, the 30-year rate averaged 6.39%.

- Freddie Mac’s current rate for a 15-year fixed-rate mortgage is 6.28%, a decrease of 0.10 percentage points. The 15-year rate averaged 5.75% this time last year.

The good news continued for home buyers this week, as mortgage rates decreased for the second time in a row.

The recent slide in rates, while small, “may provide a bit more wiggle room in the budgets of prospective homebuyers,” said Sam Khater, Freddie Mac’s chief economist, in a press release.

If you’re offered a higher rate than expected, make sure to ask why and compare offers from multiple lenders. (Money’s list of the Best Mortgage Lenders is a good place to start. Homeowners considering a mortgage refinance should consider our list of the Best Mortgage Refinance Companies.)

Use Money’s mortgage calculator to get an estimate of your monthly payment, taking different rate scenarios into consideration.

Mortgage interest rates for the week ending May 16, 2024

Freddie Mac mortgage rate trends

For its weekly rate analysis, Freddie Mac looks at rates offered for the week ending each Thursday. The average rate represents roughly the rate a borrower with strong credit and a 20% down payment can expect to see when applying for a mortgage right now. Borrowers with lower credit scores will generally be offered higher rates.

Money’s average mortgage and refinancing rates for May 17 2024

|

Loan terms |

Latest rates |

|

30-year fixed-rate mortgage |

7.504% ⇓ 0.047% |

|

15-year fixed-rate mortgage |

6.552% ⇑ 0.015% |

|

5/6 ARM |

8.139% ⇓ 0.002% |

|

7/6 ARM |

7.992% ⇑ 0.018% |

|

10/6 ARM |

7.957% ⇓ 0.003% |

|

Loan terms |

Lastest rates |

|

30-year fixed-rate refinance loan |

8.156% ⇓ 0.033% |

|

15-year fixed-rate refinance loan |

6.865% ⇑ 0.021% |

|

5/6 adjustable-rate refinance loan |

8.229% ⇓ 0.064% |

|

7/6 adjustable-rate refinance loan |

8.149% ⇓ 0.001% |

|

10/6 adjustable-rate refinance loan |

8.144% ⇓ 0.026% |

Money’s daily mortgage rates are a national average and reflect what a borrower with a 20% down payment, no points paid and a 700 credit score — roughly the national average score — might pay if they applied for a home loan right now. Each day’s rates are based on the average rate 8,000 lenders offered to applicants the previous business day. Your individual rate will vary depending on your location, lender and financial details.

These rates are different from Freddie Mac’s rates, which represent a weekly average based on a survey of quoted rates offered to borrowers with strong credit, a 20% down payment and discounts for points paid.

This week’s mortgage rate trends

Rates were lower once again this week as more data pointed toward a potential economic slowdown.

Last week’s lower-than-anticipated employment figures were followed this week by data showing that retail sales were flat in April. In a further sign of slowing economic activity, yields on the 10-year Treasury bill — which mortgage rates loosely follow — tumbled below 4.5%. And the Bureau of Labor Statistics’ Consumer Price Index yesterday reported that April’s inflation rate was lower than analysts expected.

The current downward trend is welcome news to those who see it as a possible precursor to lower lending costs. The hope is that the slowing economy will (finally) prompt the Federal Reserve to cut short-term interest rates sometime later this year.

Many analysts say the Fed will have to see more consistent signs of decelerating consumer price growth before it will cut rates. Still, even absent of action by the Fed, this week’s lower inflation reading is “expected to foster stability in mortgage rates at their current level and possibly even trigger further declines,” said Jiayi Xu, economist at Realtor.com.

Latest news in the housing market:

Here’s what’s happening in the housing market this week:

- One consequence of the recent run-up in mortgage rates is a dramatic drop in the sales of vacation homes. According to a report from brokerage Redfin, demand for second homes has decreased by 65% since 2021 and is currently at its lowest level in eight years. Other factors helping to keep second-home buyers away are high home prices and less flexible work schedules than during the pandemic.

- Despite the challenging housing market, Americans still believe real estate is the best long-term investment they can make. According to a recent Gallup poll, 36% of survey respondents consider buying a home the number-one choice for investing, followed by stocks and gold. Savings accounts and CDs, bonds and cryptocurrency round out the list of the six favorite places for Americans to park their cash.

Current Mortgage Rates Guide

Mortgage rates, along with home prices, are an important part of the formula for homeownership. Most importantly, they strongly affect how much home you can afford to buy. This guide answers some of the most common questions about rates and how they affect the housing market.

Types of mortgage rates

When shopping for a mortgage, you may be offered two types, each with a different interest-rate arrangement: fixed-rate loans and adjustable-rate loans. To decide which will best suit your needs, it’s important to understand the difference between the two.

Fixed-rate mortgages

As the name implies, fixed-rate loans have an interest rate that is stable and won’t change for as long as you have the loan. The most common term lengths are 30 years and 15 years, although some lenders offer other options. In general, the interest rate on a 30-year loan will be higher than the rate on a 15-year loan, but the monthly payment will be lower because you’re extending the payback period.

Most home buyers prefer fixed-rate loans because of their lack of surprise; the monthly mortgage payments are relatively constant throughout the life of the loan. However, the other costs that are typically rolled into the mortgage, like homeowners insurance and property taxes, can vary, and lead to variations over time in your monthly payment.

Adjustable-rate mortgages (ARMs)

The interest rate on adjustable-rate mortgages does not adjust from the start. Rather, the rate will be fixed for a predetermined number of years. Once that fixed period ends, the rate becomes variable and adjusts at a regular interval, known as the “adjustment period” — with the period length defined in the mortgage terms. Depending on market conditions, rates could either increase or decrease at the end of each period.

The most common terms for ARMs are 5/6 loans, in which the interest rate is fixed for five years and then starts to adjust every six months. There are also options for 7/6 loans and 10/6 loans. Because the interest rates on ARMs tend to be lower than those on fixed-rate loans during the initial (fixed-rate) phase of the mortgage, these adjustable loans are a good option for borrowers who don’t plan to stay in the home beyond the fixed-rate period of the loan.

Other information you should know about mortgage rates

You’ll see two different numbers when comparing rates from different lenders: the interest rate and the annual percentage rate (APR).

The interest rate is what a lender will charge on the principal amount being borrowed. Think of it as the basic cost of borrowing money for a home purchase.

An APR represents the total cost of borrowing money. It includes the interest rate, plus any fees associated with generating the loan. The APR will always be higher than the interest rate.

For example, a $300,000 loan with a 3.1% interest rate and $2,100 in fees would have an APR of 3.169%.

When comparing rates from different lenders, look at both the APR and the interest rate. The APR will represent the true cost over the full term of the loan and includes other costs like loan origination and lender fees. The interest rate is how much interest the lender is charging on the borrowed loan amount, not including additional fees. You’ll also need to consider what you’re able to pay upfront versus over time.

Mortgage refinance rates

Homeowners may decide to refinance for any number of reasons, including to lower their interest rate, change the term of their loan or tap into their home equity. Refinance rates tend to be higher than purchase rates, so carefully consider the pros and cons when determining if a “refi” is the right step.

Factors affecting today’s mortgage rates

Rates alone do not fully determine the cost of the loan and the size of your monthly payment. The following factors, which are detailed in the loan disclosures provided by your lender, also come into play.

Loan Term

The longer the loan, as a rule, the smaller the payments but the more costly the loan overall. Choosing a 15-year mortgage instead of a 30-year mortgage, then, will increase the monthly mortgage payment but reduce the amount of interest paid throughout the life of the loan.

Loan type

With a fixed-rate mortgage loan, payments remain the same throughout the loan’s life. The mortgage rates on adjustable-rate mortgages reset regularly (after an introductory period) and the monthly payment changes with it.

A mortgage whose size exceeds the federal loan limit is known as a “jumbo” or “non-conforming” loan. Such mortgages usually have lower rates but more stringent credit requirements.

Taxes, HOA Fees, Insurance

Home insurance premiums, property taxes and homeowners association fees are often bundled into your monthly mortgage payment. Check with your real estate agent to get an estimate of these costs.

Private Mortgage Insurance

Private mortgage insurance can cost up to 1.5% of your home loan’s value per year. Borrowers with conventional loans can avoid private mortgage insurance by making a down payment of at least 20% of the cost of the property or by accumulating equity that’s equal to 20% or more of the mortgage principal. FHA borrowers pay a mortgage insurance premium throughout the life of the loan.

Closing Costs

Closing costs include origination fees and other loan expenses. These extra charges typically total between 2% to 5% of the mortgage value, and are usually paid upfront. Some buyers finance their new home’s closing costs into the loan, which adds to the principal and increases the monthly payments.

Loan-to-value ratio (LTV)

The LTV measures the risk a lender is taking on by financing a property. The figure compares the loan amount to the home’s value. The higher the LTV, the higher the risk for the lender — and, ultimately, the higher the mortgage rate for the borrower.

Economic factors

Lenders use several factors to set mortgage rates every day. While every lender’s formula will be a little different, it will factor in the current federal funds rate (a short-term rate set by the Federal Reserve), competitors’ rates and other factors — sometimes including how many staff they have available to underwrite loans. Your qualifications as a borrower will also affect the rate you are offered.

In general, rates track the yields on the 10-year Treasury note. Average mortgage rates are usually about 1.8 percentage points higher than the yield on the 10-year note. In times of economic uncertainty, such as periods of high inflation, Treasury yields tend to rise. That, in turn, pushes all types of interest rates higher, including those on home loans.

How mortgage rates affect affordability

The rate on your mortgage can make a big difference in how much home you can afford and the size of your monthly payments. That’s true whether you’re buying your primary residence, an investment property or refinancing an existing loan.

Here’s an example. If you bought a $250,000 home and made a 20% down payment — of $50,000 — you would end up with a starting loan balance of $200,000. On a $200,000 home loan with a fixed rate for 30 years, here’s what you would pay:

- At a 3% interest rate = $843 in monthly payments (not including taxes, insurance, or HOA fees)

- At a 4% interest rate = $955 in monthly payments (not including taxes, insurance, or HOA fees)

- At a 6% interest rate = $1,199 in monthly payments (not including taxes, insurance, or HOA fees)

- At an 8% interest rate = $1,468 in monthly payments (not including taxes, insurance, or HOA fees)

Experimenting with a mortgage calculator allows you to find out how much a lower rate or other changes could impact what you pay. A home affordability calculator can also give you an estimate of the maximum loan amount you may qualify for, based on your income, debt-to-income ratio, mortgage interest rate and other variables. The Consumer Financial Protection Bureau can also provide a range of rates being offered by lenders in each state.

How to get the best mortgage rate

One of the most effective ways to find the best mortgage rate is to shop around. According to Freddie Mac, borrowers who get a rate quote from just one additional lender save an average of $600 over the life of the loan. Those savings go up to $1,200 if you get three quotes. A larger down payment amount will also result in a lower interest rate.

The best mortgage lender for you will be the one that can give you the lowest rate and the terms you want. Your local bank or credit union is one place to look. Online lenders have expanded their market share over the past decade and promise to get you pre-approved within minutes.

You can also lower the offered rate if you buy discount points, which are also known as mortgage points. A point typically costs 1% of the loan amount and can reduce the interest rate by 0.25 percentage points.

Compare loan options, rates and terms, and make sure your lender has the type of mortgage you need. Not all lenders write FHA loans, USDA-backed mortgages or VA loans, for example. If you’re not sure about a lender’s credentials, ask for its NMLS number and search for online reviews.

Once you find the best rate, get a rate lock to guarantee it won’t change before you can close on the loan. Getting a preapproval letter can also help.

Current mortgage rates FAQ

When will mortgage rates go down?

Mortgage rates have been trending lower after hitting a high of 7.08% last November. While most experts believe rates will eventually move into the 5% range, borrowers should expect them to remain between 6% and 7% for the foreseeable future.

Should I lock in my mortgage rate today?

What are discount points on a mortgage?

Why is my mortgage rate higher than average?

You may have a higher-than-average mortgage rate for a number of reasons. Credit scores, loan terms, interest rate types (fixed or adjustable), down payment size, home location and loan size will all affect the rate offered to individual home shoppers. One of the best ways to lower your rate is to improve your credit score.

Different mortgage lenders offer different rates. It’s estimated that about half of all buyers only look at one lender, primarily because they tend to trust referrals from their real estate agent. But shopping around for a lender will help you snag the lowest rate out there.

Should I refinance my mortgage when interest rates drop?

Summary of current mortgage rates

This week’s mortgage rate movements:

- Today’s average rate on a 30-year fixed-rate mortgage is 7.504%, a decrease of 0.047 percentage points, according to Money’s daily rate survey.

- Today’s average rate on a 30-year fixed-rate refinance loan is 8.156%, moving down by 0.033 percentage points, according to Money’s daily rate survey.

- Freddie Mac’s current rate for a 30-year fixed-rate mortgage is 7.02%, a decrease of 0.07 percentage points. A year ago, the 30-year rate averaged 6.39%.

- Freddie Mac’s current rate for a 15-year fixed-rate mortgage is 6.28%, a decrease of 0.10 percentage points. The 15-year rate averaged 5.75% this time last year.

link

:max_bytes(150000):strip_icc()/ga_7388cf91891f4602_spcms_0-2000-90efb1f2bb31450c9a292bbb87c8b6b7.jpg)